The XYZ of Equities: Younger Australians outperform Gen X and Boomers

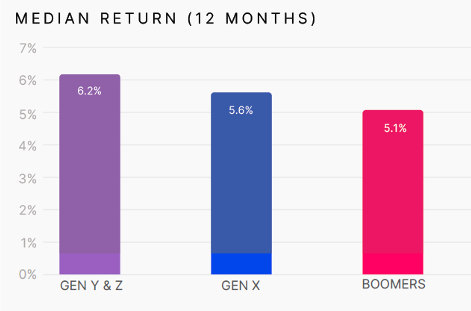

Younger Australian equity investors have weathered a year of volatile economic conditions and tightening interest rates to outperform Generation X and Baby Boomers, with Gen Y and Z investors achieving median 12-month returns of 6.15 per cent at 30 June 2023. By contrast, Gen X returns were 5.6 per cent and Baby Boomers were 5.06 per cent.

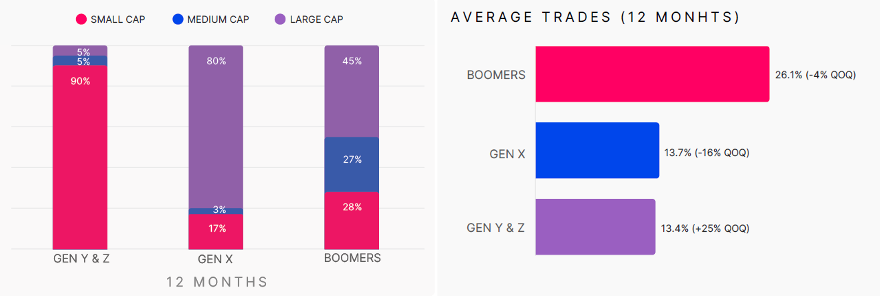

According to an analysis of almost 100,000 sponsored accounts by trading and wealth fintech Openmarkets, Gen Y and Z investors achieved these returns using a largely buy-and-hold strategy, a consistently defensive trading style, and a greater focus on the small cap end of the market.

The latest quarterly data also reveals that Gen Y and Z were the only cohort in Q2 to increase their trading volumes during the period with a 25 per cent quarterly increase to 13 annual trades. Baby Boomers continue to have the highest number of annual trades, with 26 per year on average.

All generations in Q2 continued to slowly reduce diversity in their portfolios, with the mean portfolio size of Baby Boomers now at 6.9 stocks, Gen X at 4.7 stocks and Gen Y and X at 4.4 stocks.

Other key findings include:

- Listed investment companies (LICs) saw strong net buying from Gen Y and Z throughout Q2 and the financial year. In the 12-months to 30 June, Australian Foundation Investment Company (AFIC) and Argo were among the most bought stocks.

- 85 per cent of Gen X’s trading volumes were large cap ASX stocks, whereas 84 per cent of Gen Y and Z trading volumes were small cap stocks.

- Baby Boomers had the greatest risk appetite in Q2 2023 with an investor defensiveness rating of 9.5 (offensive). By contrast, all other generations were defensive, with Gen Y and Z rating at -1.8 and Gen X rating at -4.9.

Openmarkets CEO Dan Jowett says Gen Y and Z are balancing a defensive buy-and-hold approach with a greater focus on small caps to outperform older generations.

“Despite having the lowest portfolio diversity of all generations, younger Australians have achieved higher returns by balancing exposure to small cap growth stocks with larger low-risk assets like banks and Listed Investment Companies to manage overall risk. We are pleased to see this younger cohort taking a balanced approach.”

“Listed Investment Companies have returned to popularity in the past twelve months, with many younger investors taking advantage of low LIC share prices, many of which have recently traded at a discount to asset book value.”