Diversification – The Data Room

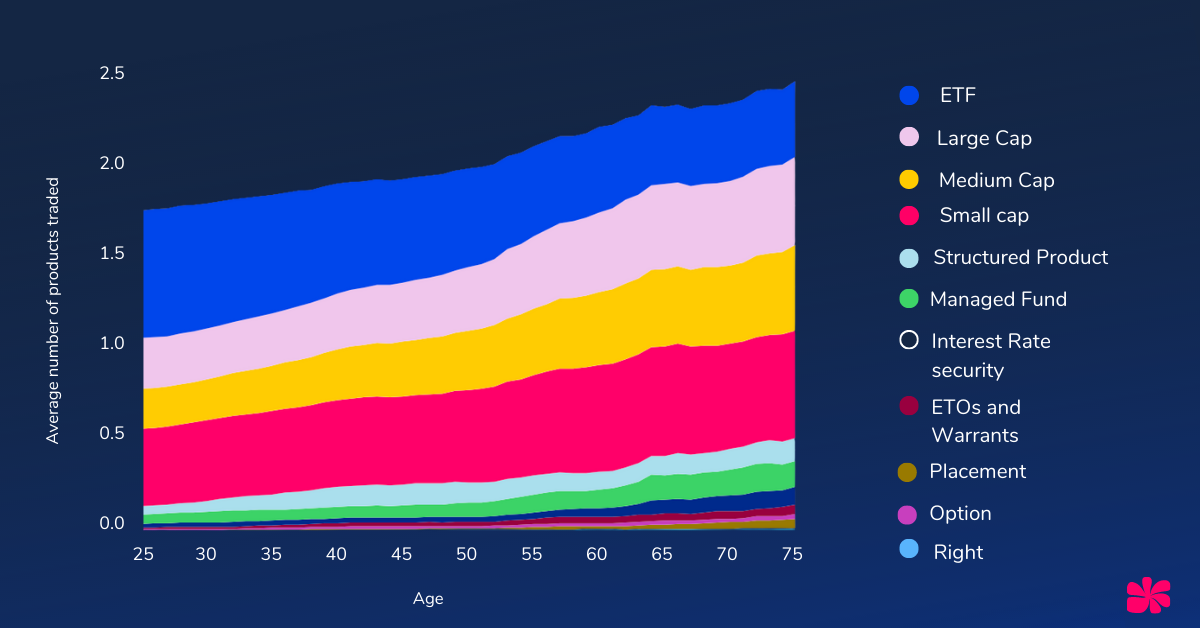

Welcome to the Data Room. Here at Openmarkets we love big data and conveniently we happen to have a lot of it! Here we uncovered some interesting insights about the diversification of investor portfolios as they age. Like a fine wine, they seem to get more robust.

Our data experts recently uncovered some interesting insights about the diversification of investor portfolios as they age.

As an investor ages they become more likely to diversify. The young players seem to favour ETFs heavily, with these making up the bulk of traders portfolios as they move through their 20s and 30s.

Playing the long game, Small Caps seem to gain popularity amongst traders as they age into their 50s and beyond. Seems that ET(F)s phoned home.

The remaining products offer an impactful addition in their offering, with traders seeming to expand their horizons with age.

Trader age vs number of products traded – Openmarkets data

The above may seem like a simple analysis, but with simplicity comes power, and actionable insight. How does your client base fit into this graph, and are you targeting the right people in the right way, with the right products?

We have plenty more where that came from... if you're an Openmarkets client interested in gleaning more insights about your client base as it sits in the Openmarkets and ASX ecosystems, reach out to your relationship manager or via our contact page to chat about all things data.

| You should consider whether any advice on our website is right for you or your clients. We don’t accept any responsibility for the accuracy any information, opinions, or predictions we’ve provided, and we obviously haven’t taken you or your clients’ personal financial situation into account. |