The XYZ of Equities: Healthcare in for Y&Z, while Boomers defensive

The third quarter of 2023 saw Generation Y & Z sell down equities in the retail sector and buy up on biotechnology, healthcare and life sciences. Meanwhile, Baby Boomers joined younger generations in shifting to defensive trading activity.

The latest analysis of 100,000 sponsored trading accounts at Openmarkets found that in the quarter ended 30th September, Gen Y & Z wasted no time selling Kogan (ASX: KGN) shares and acquiring long-time market darling, CSL Limited (ASX: CSL). CSL was also a favourite of Gen X and Baby Boomers during Q3, with all demographics capitalising on perceived attractive pricing.

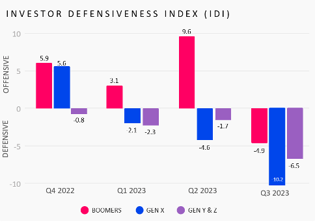

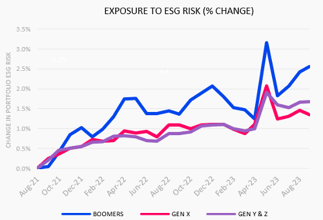

Q3 also brought notable changes in trading behaviours across generations. An underwhelming reporting season and weaker Australian Dollar influenced trading activity, with Baby Boomers joining Gen X, Y & Z in adopting a defensive approach to their portfolios. Baby Boomers’ exposure to ESG risk rose sharply in Q3, a trend consistent with all generations since August 2021.

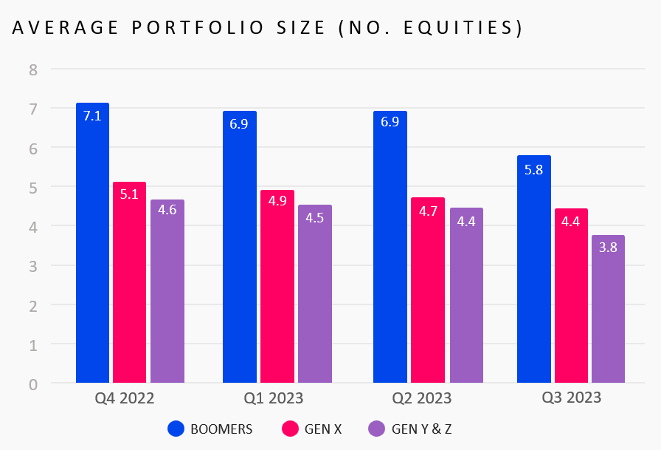

For the sixth consecutive quarter, portfolio diversification declined across all generations. The average Gen X & Y investor now holds less than four stocks in their portfolio, 17 per cent lower than 12 months ago. Baby Boomers hold fewer than six stocks, down 18 per cent year-on-year. Boomers still maintain the most diversified portfolios, measured by both market capitalisation and the number of equities held.

Gen Y & Z remain predominantly focused on small-cap stocks, whereas Gen X is more inclined toward large-cap equities.

All generations reduced exposure to resources in Q3, with concerns that global trade instability and tightening regulatory policy in the sector may restrict future growth.

Dan Jowett, CEO Openmarkets said the most notable shift this quarter was the risk appetite of Baby Boomers.

“From a bullish Q2, to falling back into line with Gen X, Y, and Z, it’s been interesting to see Baby Boomers pull back. Looking at the macro environment, they may be remembering historical events where there were long periods of inflation and choosing to play it safe.

“Meanwhile, Gen Y and Z’s investment strategies are mirroring their own lifestyles, where they are cutting back on discretionary retail spending and instead looking long-term to essential healthcare.”